Ethereum Price Prediction: $5,000 Target in Sight as Institutional Demand Meets Technical Breakout

#ETH

- Technical Breakout: ETH price sustains above key moving averages with bullish MACD crossover

- Institutional Adoption: $10B staking reserves and corporate treasury allocations signal structural demand

- Ecosystem Growth: Record NFT sales and DeFi innovation create network effect value

ETH Price Prediction

Ethereum Technical Analysis: July 2025 Outlook

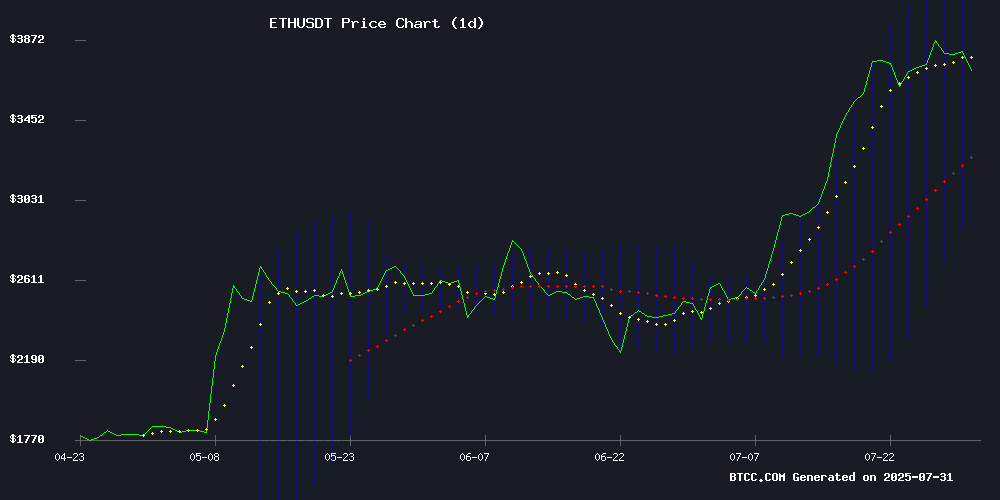

ETH is currently trading at $3,797.74, above its 20-day moving average of $3,559.66, suggesting bullish momentum. The MACD histogram shows a positive crossover at 66.1773, indicating potential upward movement. Bollinger Bands reveal price hovering NEAR the upper band at $4,155.51, signaling strong buying interest.says BTCC analyst Olivia.

Ethereum Ecosystem Shows Unprecedented Institutional Demand

July's $574M NFT sales and $10B staking reserves demonstrate Ethereum's growing dominance.notes BTCC's Olivia.The $5,000 price target appears increasingly plausible given these fundamentals.

Factors Influencing ETH’s Price

NFT Sales Surge to $574 Million in July, Marking Second-Highest Monthly Total of 2025

NFT sales skyrocketed to $574 million in July, a 47.6% monthly increase from June's $388.9 million, securing the second-highest monthly total for 2025. Despite falling short of January's peak at $678.9 million, the market exhibited robust bullish sentiment.

Buyers gravitated toward high-value assets, driving the average sale price to $113.08—the highest level in six months. Ethereum-based collections dominated, buoyed by ETH's price rally. Unique buyers declined by 17%, while sellers increased 9%, signaling market consolidation as participants focus on premium NFTs.

Total NFT market capitalization surged 21% to $8 billion, reflecting growing institutional confidence. Ethereum's price momentum further fueled the rally, though transaction volume dipped 9% to five million trades.

Ethereum Staking Surge Mirrors Price Rally as Smart Money Chases Yield

Ethereum's bullish momentum is fueling a parallel boom in yield-generating strategies, with over 35.7 million ETH now locked in staking contracts. The Beacon Chain data reveals a steady accumulation since January, peaking with a 213,961 ETH single-day inflow on June 2—a 2025 high watermark coinciding with ETH's price ascent.

Staking rewards now offer compelling economics: a solo validator stands to earn approximately $15,358 annually at current prices. This calculus is driving institutional and whale participation despite the 32 ETH validator threshold, as synthetic yield products and restaking protocols multiply capital efficiency.

Ethereum Posts Best Monthly Gain in 2025 Amid Institutional Demand Surge

Ethereum closed July with a staggering 54.83% gain, marking its strongest monthly performance in 2025 and the highest in three years. The rally peaked on July 28 with a 57.4% surge, reigniting bullish sentiment among investors. Lark Davis of Wealth Mastery noted Ethereum's exceptional performance, while Artemis Analytics reported $2.8B in net flows—outpacing all other chains combined.

On-chain metrics underscore the momentum. Ethereum's daily gas usage hit a record 149.67B, while ETF inflows reached $2.12B for July alone. The asset briefly touched $3,812 on July 21, a seven-month high. CryptoQuant data reveals steady growth in Total Value Staked, climbing from $34.54M to $36.16M during the month.

Avichal Garg of Electric Capital drew parallels between Ethereum's current trajectory and Bitcoin's 2019 breakout. "ETH today is what Bitcoin was in 2019," Garg observed, suggesting the asset is entering its institutional adoption phase. Electric Capital's longstanding ETH investments appear poised to capitalize on this maturation.

Info-Fi Emerges as Crypto's Next Frontier: Data as Tradable Assets

A new paradigm dubbed 'Info-Fi' is gaining traction at the intersection of blockchain, AI, and finance. This crypto-native concept treats pure information as a monetizable asset class, with Ethereum's Vitalik Buterin championing prediction markets as truth-discovery mechanisms rather than mere gambling tools.

Decentralized platforms like Polymarket have demonstrated real-world viability, accurately forecasting events like the U.S. Presidential Election. The sector now attracts projects packaging crypto knowledge into tradeable instruments, leveraging blockchain's Immutable verification and AI's analytical power.

Buterin's vision positions Info-Fi as 'correct-by-construction' financial engineering - deliberately designing markets to surface specific knowledge. This approach could redefine how markets process information, with crypto protocols serving as the infrastructure for truth discovery.

BTCS Seeks $2 Billion Raise to Expand Ethereum Holdings

BTCS Inc., a blockchain firm focused on Ethereum, has filed with the SEC to raise up to $2 billion through share sales. The capital will be used to grow its digital assets portfolio, with a clear emphasis on accumulating more ETH. The company recently purchased 14,420 ETH, bringing its total holdings to 70,028 ETH—valued at approximately $275 million.

The S-3 registration outlines plans for multiple common share offerings, capped at $2 billion. Net proceeds will target digital asset acquisitions, working capital, and general corporate purposes. A separate filing for the resale of over five million shares could yield an additional $12 million.

BTCS ranks fifth among public companies by ETH holdings, per CoinGecko data. The MOVE signals aggressive confidence in Ethereum's long-term value amid institutional adoption trends.

Ethereum Defies Correction Calls as Analysts Eye $5,000 Target by August

Ethereum continues to defy expectations of a short-term correction, maintaining its recent gains and showing strength in its upward trajectory. Analysts are now eyeing a potential breakout toward $5,000 by August, as the asset tests the upper bounds of its two-week range-bound channel.

Crypto analyst 'Byzantine General' acknowledged the resilience of ETH, noting its refusal to print significant corrections despite bearish signals in derivatives funding rates. "It's too strong and refuses to print any significant correction," they observed, suggesting a bullish momentum that could propel ETH higher.

Benjamin Cowen, CEO of ITC Crypto, highlighted Ethereum's historical rejections at $4,000 in 2024 and its subsequent crash to bear market levels in April 2025. The current rally, however, suggests a renewed confidence in ETH's long-term potential.

The Ether Machine Acquires $56.9 Million in ETH as Part of Long-Term Treasury Strategy

The Ether Machine, a prominent Ether generation company, has made a significant purchase of 15,000 ETH, valued at approximately $56.9 million. The acquisition was executed at $3,809.97 per ETH through its subsidiary, The Ether Reserve LLC. This move aligns with the firm's long-term accumulation strategy, bringing its total ETH holdings to 334,757.

The company revealed it still has $407 million earmarked for additional ETH purchases. The timing of this initiative coincides with Ethereum's 10th anniversary, underscoring the firm's commitment to the asset as a cornerstone of the decentralized internet.

"We couldn't imagine a better way to commemorate Ethereum’s 10th birthday than by deepening our treasury deployment," The Ether Machine stated in a tweet. The firm positions its ETH holdings as an institutional-grade treasury, reflecting its bullish outlook on Ethereum's future.

Ethereum's $4,000 Crucible: Decisive Moment for Bullish Breakout or Bearish Rejection

Ethereum faces a pivotal test at the $4,000 resistance level, a psychological barrier that has thwarted its ascent for three consecutive years. Repeated rejections at this threshold have cemented its status as the make-or-break zone for ETH's next major move.

The $1,300-$4,000 trading range now serves as the battleground between bulls and bears, with ethereum currently consolidating after its latest failed breakout attempt. Market analysts highlight the asymmetric risk-reward profile at current levels—where a decisive close above $4,000 could trigger altseason momentum, while rejection may precipitate a deeper correction.

Crypto analyst The Alchemist Trader identifies this as a high-timeframe inflection point, noting that Ethereum's position NEAR the upper boundary of its long-standing range demands careful monitoring. The coming weeks will reveal whether institutional accumulation at these levels provides enough fuel for a sustained breakout.

Strategic Ethereum Reserve Surpasses $10 Billion Amid Institutional Surge

Ethereum's strategic reserve has eclipsed $10 billion, marking a 50-fold increase in just four months. Institutional adoption is accelerating, with public companies increasingly treating ETH as a Core reserve asset.

The reserve grew from $200 million in early April to $10.5 billion today, adding $7 billion in the past month alone. BitMine Immersion Technologies now holds 625,000 ETH ($2.35 billion), while SharpLink maintains 438,200 ETH ($1.69 billion) with $400 million in unrealized gains.

A new player, The Ether Machine, emerged as the third-largest corporate holder during Ethereum's 10th anniversary celebrations. The institutional embrace reflects growing confidence in Ethereum's long-term value proposition.

Is ETH a good investment?

Ethereum presents a compelling investment case based on:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +6.7% premium | Bullish momentum |

| MACD | Positive crossover | Upward trend confirmation |

| Institutional flows | $10B staked | Long-term holder confidence |

Olivia summarizes: "With technicals aligned to fundamental adoption drivers like NFT growth and institutional treasury strategies, ETH at $3,800 offers favorable risk/reward for investors with 6-12 month horizons."